Payroll deductions online calculator 2023

Discover ADP Payroll Benefits Insurance. Paycors Tech Saves Time.

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms

Free 2022 Employee Payroll Deductions Calculator.

. Find The Right System To Manage And Support Your Employees From Hire To Retire. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. About the US Salary Calculator 202223.

The maximum an employee will pay in 2022 is 911400. This is 1547 of your total income of 72000. Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Time and attendance software with project tracking to help you be more efficient. Get Started With ADP Payroll.

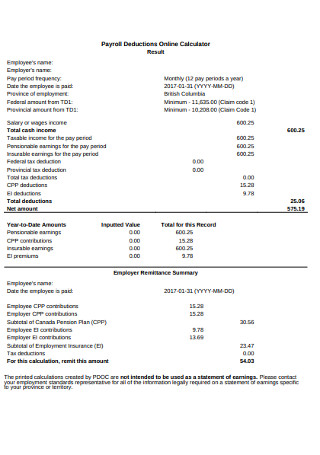

Ad Process Payroll Faster Easier With ADP Payroll. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. No Need to Transfer Your Old Payroll Data into the New Year.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. The Payroll Office is responsible for the final payroll process that issues.

Ad Plus 3 Free Months of Payroll Processing. Take a Guided Tour. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Form TD1-IN Determination of Exemption of an Indians Employment Income. How to use a Payroll Online Deductions Calculator. Try out the take-home calculator choose the 202223 tax year and see how it affects.

Ad Process Payroll Faster Easier With ADP Payroll. Pay dates are the last work day on or before the. Ad The Best HR Payroll Partner For Medium and Small Businesses.

Free Unbiased Reviews Top Picks. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Ad Break up with punch cards timesheets and long days of calculating everyones hours. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Taxes Paid Filed - 100 Guarantee. You first need to enter basic information about the type of payments you make. We Can Help You Make The Right Decision.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Calculate how tax changes will affect your pocket. Estimate your federal income tax withholding.

ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown. 2022 Federal income tax withholding calculation. The tool then asks you.

1547 would also be your average tax rate. If your employer runs a. Our Expertise Helps You Make a Difference.

An updated look at the Boston Red Sox 2023 payroll table including base pay bonuses options. How It Works. See how your refund take-home pay or tax due are affected by withholding amount.

Salary commission or pension. Get Started With ADP Payroll. Ad Make Your Payroll Effortless and Focus on What really Matters.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. Discover ADP Payroll Benefits Insurance Time Talent HR More. 2022 Federal income tax withholding calculation.

Your taxes are estimated at 11139. Sage Income Tax Calculator. The exception is where there is a pre-existing.

Start Afresh in 2022. Prepare and e-File your. Subtract 12900 for Married otherwise.

Use our payslip calculator to check the correct tax and other deductions have been made fully updated for tax year 2022-2023. Ad So Many Payroll Systems So Little Time. Deductions from salary and wages.

Rates and thresholds for. Ad Compare This Years Top 5 Free Payroll Software. Get your business set up to run payroll.

Your income puts you in the 25 tax bracket. Discover ADP Payroll Benefits Insurance Time Talent HR More. Total Non-Tax Deductions.

Ad 4 out of 5 customers reduce payroll errors after switching to Gusto. Its so easy to. Use this tool to.

Payroll Guidelines for 2022-2023. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Subtract 12900 for Married otherwise.

Free Unbiased Reviews Top Picks. Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions.

How To Calculate Taxes On Payroll Top Sellers 59 Off Pwdnutrition Com

Payroll Deductions Calculator Best Sale 56 Off Www Alforja Cat

Budget 2022 Your Tax Tables And Tax Calculator Bvsa Ltd More Than Just Numbers

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

Taxes Calc Top Sellers 55 Off Pwdnutrition Com

How To Calculate Taxes On Payroll Top Sellers 59 Off Pwdnutrition Com

How To Calculate Taxes On Payroll Top Sellers 59 Off Pwdnutrition Com

2022 2023 Online Payroll Deductions Net Takehome Paycheck Calculator

Payroll Deductions Calculator Best Sale 56 Off Www Alforja Cat

Cra Online Calculator Outlet 54 Off Www Alforja Cat

Payroll Deductions Calculator Best Sale 56 Off Www Alforja Cat

Tax Calculator For Weekly Pay Store 66 Off Avifauna Cz

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Estimated Income Tax Payments For 2022 And 2023 Pay Online

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube